EPIQUE NEWS LIVE

Blount County 3rd Quarter Update

Blount County 3rd Quarter Update

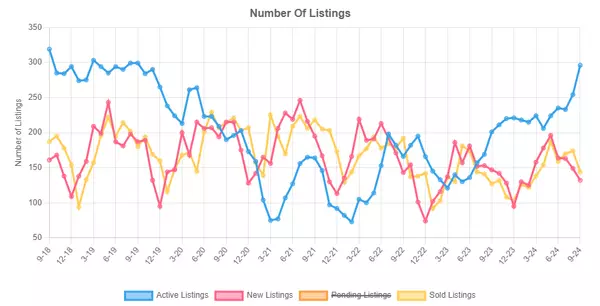

The 3rd quarter has come to a close and it's time to check out the data. What's happening with the real estate market in Blount County Tennessee?Well, there's a bit of a lull. You may not feel it, but for those of us who are in it every day, there's a lull. I remember feeling this back at the end of 2012. Back then, when I was in Puget Sound, the market was shifting from a buyer's market to a seller's market. Once 2013 hit, the buyers came out of the woodwork buying up everything. Along with that, the inventory started to drop. We weren't getting as many listings. In fact, from 2008 to 2018 or so, the inventory in Western WA (the NWMLS) dropped from 50k to 5k. It literally dropped 90%. Now, you may be asking, what does the Puget sound market from a decade ago have to do with the market here in Blount and East TN? Well, numbers speak. Unfortunately, I can't look at the data in the same way here as it's a bit more limited. But, what I can tell you is it feels the same. There is a shift of sorts happening or maybe just a lull. The big question is, is it shifting into a buyer's market or is it a calm before the storm of major buyer activity (thus ramping into a heavy seller's market)?We don't know. But, my feeling is that it's more of a ramp up back into a seller's market. Our data continues to favor sellers. While this chart shows that the inventory is up substantially, something to be aware of is the way this chart is made. They simply look at the number of active listings on the 15th of each month and report that. It's not my favorite, but it's all I got right now. You can still see a trend, but I don't know that it's as good of an indicator as others. The new inventory is the big one to me. The new inventory is on a down trend and over the past few years you can see that the new listings to market have made lower peaks. That's not good for buyers. The peake this year was in May. Sales of course have slipped because there's not much new coming on the market. With this data we can determin the months supply of inventory which currently sits right at 2 months. A 2 month supply is still a seller's market. The last time we were at 2 months supply was November/December of 2023. Prior to that was January 2019. With this volatility in supply, prices are volatile. The average price for Blount County has made some significant drops in recent months, meanwhile the median price has been mostly steady. The median sits at $392,950 and the average is at $415,441. You can see that since March of 2023, we've been flirting with a median price of $400,000. I'm willing to bet that come spring, we'll go over that number and it will stay fairly consistently over $400k. What are you wanting to do? Thinking of buying your first home? Considering investing? Do you need a place for your parent(s) to live with you? Let's chat about your needs and how to get what you need in today's market. Give me a call today!

MORE

Should You Wait to Buy a Home in Knox County?

Should You Wait to Buy a Home in Knox County?

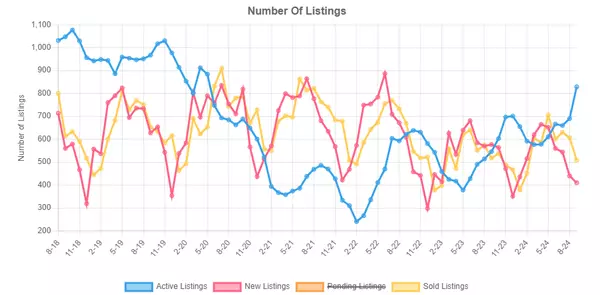

October has hit and we are now approaching the typical slower time of year for real estate. And by slower, I simply mean that there's less sales and lower inventory. It doesn't mean that it necessarily takes longer to sell homes - but it could. So, is now a good time to buy? We have an election coming up and there are many unknowns coming down the line. What will happen with interest rates? If one party is elected they are promising $25k to help certain first time home buyers (not all though) and they are promising to build 3M new homes (not sure how they can promise that though). For all intents and purposes, we have been in a recession and it appears we'll continue in that path. Will a new president and other elected officials have an impact on that in the coming year? Only time will tell. What I do know is this: when you try and time the market to get the best deal, you lose. No one who bought at the bottom ever did it on purpose. They didn't know it was the bottom. They have felt like they were close, but there was no telling that it actually was. With that, let's consider what's happening in Knox county. The new homes on market continues to shrink. Since April, the number of new properties coming to the market has continued on a massive drop. The new listings in September were nearly 40% less than than came on the market in April. The peak of new listings is the lowest it has been over the last decadeThe sales have followed. Because the sales are barely keeping up with the new inventory, the old inventory sits longer. Because of the lack of inventory the prices remain high. The average price has dipped a little, but the median is up. As I continue to hear people complain of high prices or say they're waiting for a crash, I continue to ask the question - what's going to pop: the demand for housing? Or the supply? The demand has to drop drastically or the supply has to increase. You can see, the supply keeps dropping but demand is keeping pace with the supply. So prices continue to move up a bit. The month's supply of inventory is still low at just 1.6 months. While the chart looks drastic, I will remind you that we need 4-6 months to have a balanced market. The top of this chart going back 6 years is at 2.2 months - half of what is needed for a balanced market. So, is now a good time to buy? Well, it can be. What are your goals? Are you trying to save on price? Are you trying to save on interest rates? Are you waiting for more income? Do you want to invest? Your goal greatly determines whether or not now is a good time to buy. So, give me a call and let's chat about your goals. Now is definitely the time to plan and perhaps it is a good time to buy.

MORE

Does it feel slow to you?

Does it feel slow to you?

September is here and the weather is starting to shift a bit. We've got less humidity and cooler mornings. With the fall typically comes some cooling in the real estate market. I think many people get busy and pre-occupied with work, school, and upcoming holidays and aren't always thinking of buying a home. Interestingly, the 4 of the last 5 homes I've purchased (including investment properties) were purchased in fall/winter. Two of them were in December!What's happening with the market now? Well, it certainly feels like some cooling. Nationally, the inventory level has been on an updtrend since February of 2022. That's mostly been true locally as well. What's different is that sales nationally have been on an uptrend as well. Locally it's stayed more consistent rather than an uptrend. The other thing that's a bit different is that over the last 4 months in Knox county, the new listings have continued to drop. That's keeping inventory low. In both Blount and Knox county, median days on market is increasing along with the avergae days on market. More homes are starting to sit a bit longer. This cooling is somewhat seasonal, but there are also buyers sitting on the fence waiting for the election. I'm not sure what they expect will happen exactly with the election because there isn't much that happens fast. I think many people knew the economy would go down when Biden took office, but it took a good year and a half for mortgage interest rates to go up and then inflation took off. It's a delayed response. So regardless of who takes office, I don't believe there will be any over night change. Currently though, they are expecting a drop in interest rates this month. https://themortgagereports.com/32667/mortgage-rates-forecast-fha-va-usda-conventionalThey are still expected to be above 6%, but it's better than the high of 7.7% from last year. One of the interesting things you should notice is how advertised rates have higher fees. I'm seeing advertised rates in the mid 5's but that is with nearly 2 points paid (2% of the loan amount). So in other words, if you get a loan for $400k, you'd have to pay $8000 to get that 5.5% rate. So, be sure to read the fine print!Prices in Blount county are flat. The average price is down just a hair to $477,674 and the median is up to $399,498.Knox county's prices are showing similar trends. The average price has come down over the last two months to $480,399 and the median is basically flat at $399,950. What are you plans? Are you setting aside your plans for a few months? Or are you getting ready to take advantage of this lull in the market? Let's chat and build out a great strategy for you to grow your wealth through real estate.

MORE

Combined Blount County and Knox County Summer Update

Combined Blount County and Knox County Summer Update

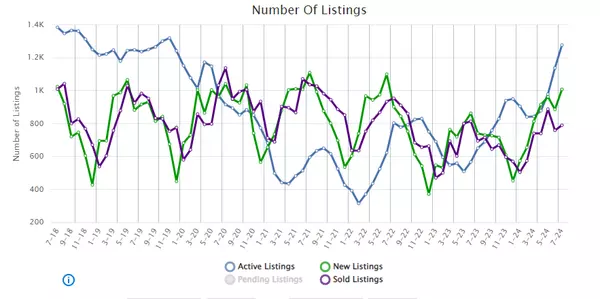

This month I thought I'd do a combined update given that the trends are pretty similar for both Blount and Knox county. Also, there's a lot of overlap given I've talked with plenty of people who are open to living anywhere from Farragut to Maryville. As always, if you want some information as it relates spicifically to your neighborhood or home, just reach out and I'd be happy to give you a custom market analysis. In general, since December the new homes on market has been on an up trend. It has had some dips in the counties, but overall, it's up. In this combined chart, it's all straight up. But so are the sales. Up until June they were tracking right with new inventory. June saw a small dip, and then July was just barely up. Based on what I'm seeing right now, I expect to see sales go up in August. Given how the sales have been keeping up with the new listings for the most part, we are seeing the month's supply of inventory stay pretty low at just 1.6 months. All of this has kept prices up. They aren't really "going up", but they are staying. From June to July there basically no change in average price but a slight dip in median price. The average price for the combined counties is $492,780 and the median price is $400,000. That median dip to $400k is still higher than any other time. I want to address the elephant in the room: a market crash. I've heard this from a few people lately and in fact I've heard it from numerous people since about 2015. Because the 2008 crash is so fresh in our minds, even 16 years later, many people assume another has to come. The big question that I have is what is going to cause that crash. In 2021 the big forecast was a huge market crash because there were 1,000,000 short term rentals around the country and these owners "were losing money" or "had bought at the height of the market" or some other non-sense. They thought these owners would have to foreclose and bring a glut of homes on the market. In fact one youtuber I watched predicted the market to crash last fall. It didn't. In fact I was telling people that we were so low in inventory that if 25% of those short term rental homes (250,000) came to the market, that would only increase the supply by like 10-15%. If you spread them out evenly (which they wouldn't be, but let's pretend), that'd be 5000 new listings in TN. So basically let's say 2500 for East TN. Then if you figure the greater Knoxville area, it still would have only been maybe 1000. That's a 25% increase. But, when our inventory is so low that we had a 1 month inventory at that time, it would have been welcomed to bring much needed supply to the demand. It would have slowed down price increases, but it would not have been a crash. So, why? Why is the market going to crash? I will tell you exactly what to look for. We need a massive supply increase or a massive demand drop. I really don't think the demand is going to drop especially as rents increase. So, what's going to cause a massive supply increase? New Construction boom, massive foreclosures, or many people dying. It can't be "a bunch of people will finally decide to sell" because they have to move somewhere. In order for that to have an massive increase that's not absorbed, they'd have to move at least a couple hours out of the market. The only reason for massive foreclosures is people not being able to pay their mortgage which would be from job loss. But also, there are many that bought their homes prior to 2020 and are paying a 2.8-3.5% interest rate and have really low payments that can be handled with other jobs. I just don't see a recession causing a massive foreclosure issue. But even if it does, there are plenty of investors out there to snatch up homes and turn them into rentals. The crash that happened in 2008 was unforseen by most. Now everyone is watching AND we have new regulations to prevent that sort of thing. So, if you're waiting for a bust, I wish you the best, but would advise to not wait long. Just take a look at the long term price history. If you're looking for a dip, this may be it. As an aside, anyone who bought their home at the height, in 2007, had their appreciation back by 2013 (nationally). So, notonly was the house worth more in 2013 than in 2007, they would have been paying down the principal for 6 years and at that point could have refinanced into a lower rate and lowered their payment. I know that may have been a bit long winded, but I felt it was important to share at this time. If you have questions or would like to strategize about your next move, please reach out!

MORE

Loudon County Mid Year Review

Loudon County Mid Year Review

As we have just passed the midway point for the year, it's time to check out what's happening in Loudon county. Right of the bat we can see that the inventory has taken a pretty huge jump this year. The new listings were rising at a pretty steep angle and it appears the sales just quite didn't keep up with it. That has changed over the past two months with each of those being down in regards to new listings but the overall active inventory has remained high. This has impacted prices as they are still below the all time high which was July of 2023. But they are up above the other data points. The average price right now is at $569,000 and the median is at $515,000. The month's supply of inventory is right around 2 months. This is still a seller's market, but if the sales continue the down trend, Loudon could be moving closer to being balanced and not favoring either buyers or sellers. How does this information impact your plans? Let's chat and build a strategy to help you move forward with your goals!

MORE

Anderson County Mid Year Review

Anderson County Mid Year Review

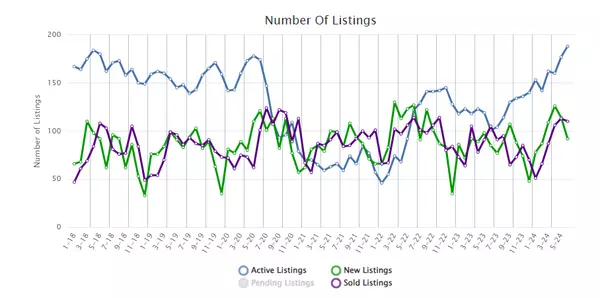

How's it been in Andersoun county this year? Well, most trends don't stop at county lines and you'll find a similar trend in Anderson as you do in Knox and Blount. Generally, the inventory is still low. The new on market for the month continue to be at a lows well below where they have been just a couple years ago. You can also see how sales (purple line) have taken a dip but that's to be expected when the inventory is so low. One thing that is a little different from Blount and Knox is that the prices had taken a dip, but are now back on the upswing. Anderson county is averaging a $336,000 sales price and the median is right at $320,000. But overall, you can see that prices are up. There's no real end in sight to the upward trend. The inventory has remained low across the whole area and that's going to continue to keep prices up. Are you thinking of buying or selling in Anderson county? Give me a call and let's chat about how to use the market to your advantage!

MORE

Knox County Half Year Update

Knox County Half Year Update

Knox County continues to grow. Much like Blount County, Knox County has had a decrease in new listings on the market and some decreasing sales but prices remain up. Many home owners are still hesitant to sell due to the rise in interest rates and home prices both. Many would rather stay and fix their home up. This has been a trend over the last decade and where in the past many would be downsizing, they are instead simple remodeling. I have two different data sources that actually vary a bit in the numbers, but are similar in showing the trend. At this half year update, I'll share both so you can get a better idea of what's happening. What you can see in these charts is how the new listings are dropping. It's been a long two years of lower new inventory. We just aren't getting the same number of new listings like we used to get. That's one reason, in my opinion, that we don't have as many sales. Of course interest rates and inflation have played a factor to that as well. But despite the lower inventory, sales are still happening and those sales continue to push prices. Knox County has hit a new all time high of $501K for average price. The median is also at an all time high of $405,000. There is about a 1.5 month inventory in Knox county, which is extremely low. It's still a seller's market as far as inventory is concerned. One thing that could be changing though is interest rates. Rates are rumored to be coming down later this year. That could actually boost sales. There's a lot of buyers waiting for rates to drop. If they do, those buyers could be streaming into the market and snatching up properties at the lower rates. So don't expect price drops if the rates drop. How can I help you? What are you trying to do with your living situation? Buy a first home? Upsize? Something else? Let's chat and put together a plan to help you move forward!

MORE

Blount County Half Year Update

Blount County Half Year Update

Well, it's been an eventful first half of 2024. We've seen all kinds of things in the economy, politics, real estate, weather, and more. But let's just focus on real estate for now! The first half for Blount county has maintained the recent trend of low inventory. I have a few different data sources and while they do have some differences, no matter how you slice it, the inventory just is not where it should be. I'll post two of them in this blog so you can see what I'm looking at. In one of them, you can see that in the past we would routinely be up over the 200 mark for new homes on the market, but it's showing that we haven't been there since June of 2022 - so it's been two years! In the other data set, it shows the high mark being at the 250 point but still we haven't been there since June of 2022. That's what I mean when I say that the data seems to be a littl different, but shows the same trend. The overall active inventory (blue line in the above pic, or also in the pic below) appears to be stagnant or moving up slightly. This is because sales are down. But as I've stated in previous blogs, I'd suggest that sales are down because inventory is down. I actually just had clients offer on two different houses the city of Maryville that were priced somewhat reasonably, probably slightly low, but both had multiple offers. One was bid up by over $30,000. And yet, others are sitting. Some potential good news for buyers is that mortgage rates are expected to dip later this year. This is due to some slowness in the economy and a cooling of inflation: https://money.usnews.com/loans/mortgages/mortgage-rate-forecastWhile this may seem like a breath of fresh air to home buyers, something to keep in mind is that it's motivating for MANY buyers. So you could see a bunch of buyers get off the fence when that happens thus moving prices up. Some homes that may have been sitting and lowering their price may all of a sudden get multiple offers. I've seen it before and it could certainly happen again. The month's supply of inventory still sits right around 2 months which is still a seller's market. The prices are moving up. Blount county pushed up to a new all time high median price of $412,000...or $419,000 depending on the data you're looking at. The average price pushed up to $460,000, still below the all time high of $497,000. So, if you're waiting for a crash...you could be waiting a lot longer. And in a hypothetical, let's say it took two more years for a "big" crash. But how much higher are prices going to push before they would come down? And would they simply come back down to today's prices or last year's prices? Where will interest rates be? Don't try to time the market, but rather make sure that you're in a good place to buy and hold. Even those that bought in 2007, were able to sell by 2014-15 for a profit. How does this affect your plans? Give me a call or email and let's chat about your your plans to buy, sell, or invest!

MORE

Is the Blount County Real Estate Market Stalling?

Is the Blount County Real Estate Market Stalling?

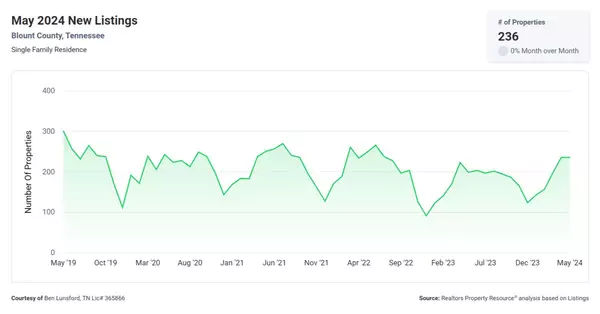

The Blount county market is still seeing some sideways movement. The inventory was finally picking up but then May it stalled. We had the same number of new listings in May as April. People just aren't selling. Again, the active inventory has been on an overall uptrend since March of 2021, with normal highs and lows, but this is pretty low still. We've seen the high month be in the fall in recent years so we'll have to wait and see if that trend continues. Despite the lower inventory, sales are up. Sales have been consistently up since December, with a sharp uptick this past month. The past couple years, May has been the high month for sales. I don't think that trend will continue, based on the pending properties. I think we'll see some higher numbers in June and July. This has kept our months supply of inventory low at just 2.15 months. This is much higher than it was just two years ago - in fact it's 4 times higher, which is a good thing to get into a balanced market. It honestly feels a bit like a balanced market despite having less than a 4 month supply. The prices show us still being sideways. Much like Knox county, Blount is flirting with the $400,000 median price point. It was at $399k in April but dropped to $376,000 in May. Technically year over year it's down from $405,000...but that could likely change next month. In fact, I wouldn't be surprised to see a median price over $400,000 in June. What do you need help with? Are you thinking of buying this summer? Maybe making a move in the fall? Reach out to me and let's chat about your plans and build a strategy to move you forward!

MORE

What's happening with Knox county prices?

What's happening with Knox county prices?

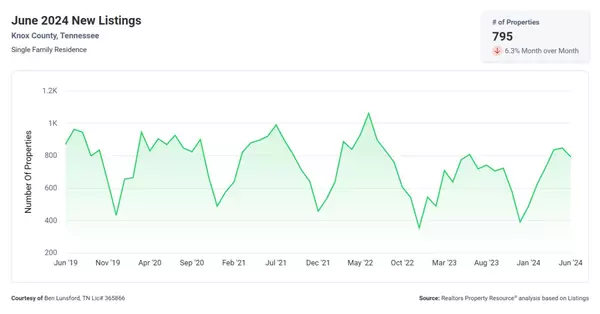

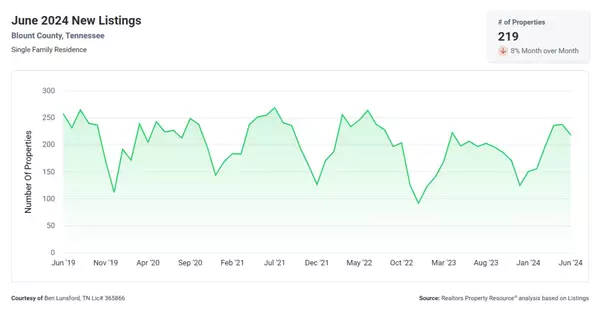

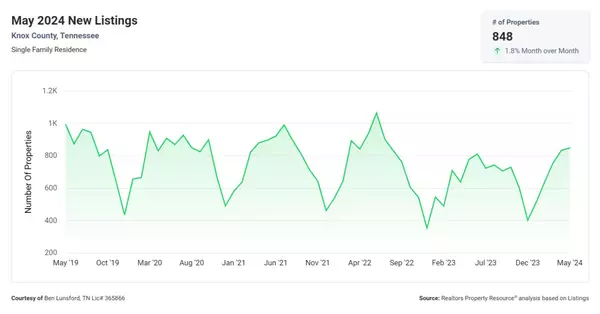

Time for the June Market update! The real estate market through May has continued to be strong for sellers in Knox county. So far it's been following the tpyical trends of more listings and more sales through spring. May saw 848 new listings come on the market in May that's a moderate increase of 1.8% over April, but it's 9.2% higher than May of 2023 which was one of the lowest years in recent times. Those new listings brought the overall listings up a little, but still down from the peak in October. May seems to be the early ramp up in listings in previous years, so I expect to see more in the coming months. With the increase in listings we've also seen an increase in sales. It's a modest increase of just 1.4% over May 2023. In 2023, June was the peak for sales. Based on what I see in pending sales, I think this June we'll see a much higher number than 2023. This has kept the months supply of inventory low. We are ahead of May of 2023, but it's still seller's market teritory being at just 1.5 months. And of course our prices. The median price is up from May of 2023 by $1500. So, year over year it's up, but barely. You can see in this chart that it remains in the "sideways" mode where it's just flirting with the $400,000 number. We're either going to crest that number this summer and hang above $400k for a few months before the fall/winter, or we're going to hit and the market will reject a $400,000 median price for Knox county. Only time will tell, but my bet is that prices move up based on our supply and demand right now. How does this data affect your plans? Thinking of making a move? Contact me today and let's make a plan to help you move forward!

MORE

Knox County Housing Market - May 2024

Knox County Housing Market - May 2024

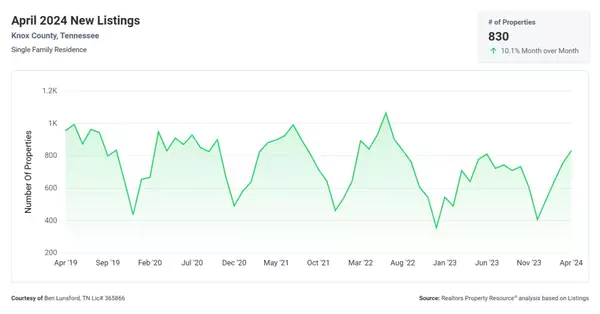

This year for Knox county has gotten off to a somewhat hot start. Every month from January through March we've seen an increasing number of sales...until April. We've also seen a consistent increase in new listings on the market since December. Increased listings is good, a slow down in sales less so. But this slow down is pretty small. Let's take a look at the charts. First off, our new listings on the market: The new listings in April (830) are the same as in April 2020 (831) but a little lower than 2022 (840) and a lot lower than 2021 (881). So I'd say we're moving the right direction in increasing our supply. Although it's on the rise, our overall active inventory is still low. We are above the most recent years, but still lower than 2020. This low active inventory is due to more pending properties. Since December, pending properties has gone practically straight up. We haven't had this many pending properties since June of 2022. This should lead to increased solds in May/June. Now for the solds, which have been on the upswing, took a small dip for April - 8% drop from March. But, as you can see in the chart, months ebb and flow and I don't think this is any indicator of a bad month brewing for May. Our prices are being driven by supply and demand. Right now supply and demand are somewhat even thus keeping prices in sort of a swing state or a plateau of sorts. We've been in the same range over the last 12 months with a low of $365,000 for the median price up to a high of $395,000. April finished with a median price of $387,000. The average price is following a similar trend, but sits higher at $450,000. The months supply of inventory is still really low. It climbed to it's high of 1.69 months in November 2023 - a number we hadn't seen since April of 2020. But it's dipped back down below 1.5 months to just 1.33 or just 40 days of inventory. I still think this data points towards a swing or mixed market. The months supply shows a seller's market, the pricing shows a swing market, the sales show a buyer's market, but the inventory brings us back to a seller's market. It's just a mixed bag right now. So, if you're thinking or buying, you really should have a strong agent who understand market dynamics to help you take advantage of the opportunities that are there. How can I help you? Send me an email or give me a call today!

MORE

Are we headed towards a buyer's market in Blount County?

Are we headed towards a buyer's market in Blount County?

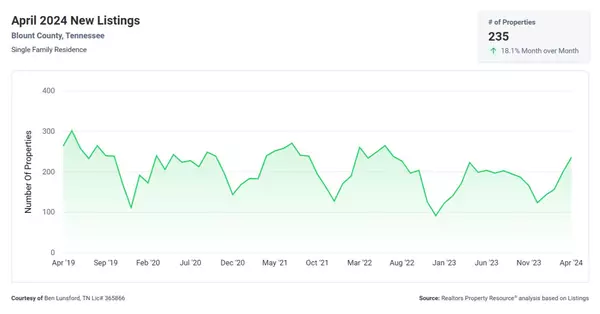

A lot has been happening in the real estate market in recent months. There's been a lot of speculation about what the future holds. Today we'll have a check up on the Blount county market looking purely at the data. It's a little mixed, but really it's been sideways over the last year so the trend seems to be holding.Let's first take a look at new listings: There were 235 new listings for April 2024. That's an increase of 5.3% over 2023. That's a good thing because we've been low on listings for quite some time. But that number is the same as April 2022 and lower than April 2021 and much lower than the 265 number we saw in April of 2019. So we're still not where we want to be. That shows in the overall listing number seen in the next chart: While the overall listing inventory has been slowly climbing since March of 2021, it's still not where it needs to be for a balanced market. We are higher than previous Aprils though...just not April 2019. I don't normally highlight pending listings because pendings can fall out anytime. But, the past couple of months it's been skyrocketing seeming to indicate that the demand is increasing thus eating up those new listings. You can see in this chart, we haven't been at this level of pending listings since September of 2021 Our sold properties have been down overall and in fact have been on a down trend since 2021. But, we did have more sales than April of 2023...by 5. So not huge growth, but it didn't drop. I think that speaks to the continued demand in Blount county. All this leads to our months supply of inventory. This is one of the bigger indicators of whether or not we are in a seller's market or buyer's market. Typically we need to have a 4-6 month inventory to be in a balanced market where it doesn't favor buyers or sellers. Currently Blount county is hovering just under 2 months of inventory. This has been on a steday incline cince March of 2021. And of course, what everyone wants to know - prices. What are prices doing? Well, with this sideways market they are still hovering. Blount county has been flirting with the $400k median price since March of 2023. As of April, the median price is sitting at $397,000. Meanwhile, the average price has bounced up to $443,000. The average price has been on a down trend from the high of $497,000 in September of 2023. With this increase in demand (seen in the pending listings) this may bounce back to last year's high. How does this impact your real estate plans? Have you been thinking of making a move? Give me a call and let's chat about how to make the best move in any market.

MORE